Tradução e análise de palavras por inteligência artificial ChatGPT

Nesta página você pode obter uma análise detalhada de uma palavra ou frase, produzida usando a melhor tecnologia de inteligência artificial até o momento:

- como a palavra é usada

- frequência de uso

- é usado com mais frequência na fala oral ou escrita

- opções de tradução de palavras

- exemplos de uso (várias frases com tradução)

- etimologia

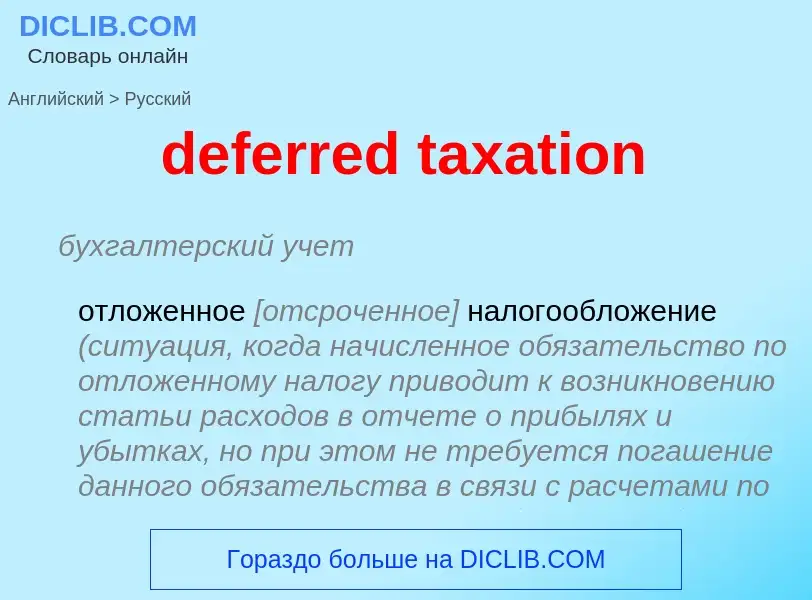

deferred taxation - tradução para russo

бухгалтерский учет

отложенное [отсроченное] налогообложение (ситуация, когда начисленное обязательство по отложенному налогу приводит к возникновению статьи расходов в отчете о прибылях и убытках, но при этом не требуется погашение данного обязательства в связи с расчетами по налогу на прибыль за текущий отчетный период)

бухгалтерский учет

отложенный [отсроченный] налог на прибыль (статья в отчете о прибылях и убытках, увеличивающая или уменьшающая совокупные расходы по налогу на прибыль таким образом, чтобы они были равны произведению ставки налога на прибыль и бухгалтерской прибыли до налогообложения, откорректированной на статьи расходов и доходов, не принимаемых для расчета налогооблагаемой прибыли, ни в отчетном периоде ни в будущем)

синоним

Смотрите также

Definição

Wikipédia

Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment. Deferred tax liabilities can arise as a result of corporate taxation treatment of capital expenditure being more rapid than the accounting depreciation treatment. Deferred tax assets can arise due to net loss carry-overs, which are only recorded as asset if it is deemed more likely than not that the asset will be used in future fiscal periods. Different countries may also allow or require discounting of the assets or particularly liabilities. There are often disclosure requirements for potential liabilities and assets that are not actually recognised as an asset or liability.